June 2009

Welcome to the first issue of the Beyond the Deal Newsletter.

The Beyond the Deal book developed a unique approach to create extraordinary value

through acquisitions. The Newsletter is a forum designed to extend that approach and

continually renew it. It is a venue to fill out and more fully explore key integration

issues that are central to the post acquisition integration community. The Newsletter

welcomes your interest and inputs to make that conversation as rich and useful as

possible.

In This Issue:

• Why a Beyond the Deal Newsletter?

• What the Newsletter Looks Into

• Issues and Trends

• Recent M&A’s: The Jury is Still Out on Their Success

• Four Levels of M&A Capability – Moving Your Company Through the Next

Levels

Why a Beyond the Deal Newsletter?

The Newsletter explores how you can:

• Leverage M&A’s as strategic springboards for unprecedented performance and value creation gains • Achieve those gains, with timely and updated information about how to make a major M&A work for you, from strategy setting through integration and culminating in your newly combined company

• Gain a network of sources and colleagues to help you meet the goals for an overall successful integration, not just on the “deal”

• Go beyond the focus on financial and physical resources by taking into account the intangible assets that are increasingly what makes the difference in enabling

exceptional outcomes

• Put together the facts of your integration and develop responses to ever changing conditions, some expected and some very surprising

• Establish an expertise center for integrations

To accomplish these goals, the Beyond the Deal Newsletter looks into:

• Appraisals of trends and issues in M&A’s

• Commentaries on developments in the field

• Interviews with leading players involved in acquisition integrations and

• Mini-case studies of both those organizations that use the full range of organizational capabilities for quantum leap outcomes, as well as firms that have not

Trends and Issues:

Chaos, Change and the Advent of the “New Normal”

The unanticipated global recession in 2008 not only significantly cut into the amount

and scope of major acquisitions taking place, but changed the acquisition market and

standards for post merger integrations as well.

The severity of the economic downturn also led to a series of major acquisitions that

few ever thought would happen. A number of major financial trading firms (and other

firms caught in the recession undertow) came under such distress that they were no

longer able to survive as solvent companies and were subject to forced acquisitions.

On the other side of the coin, this unexpected set of circumstances has brought about

an extraordinary time to acquire. Companies with substantial assets and strong

balance sheets have a window of opportunity to take advantage of depressed stock

pricing and tighter financial credit conditions to stage acquisitions that were almost

unthinkable just a year ago. This is an exceptional time to acquire a wide variety of undervalued, stressed but quite good companies, “not at Cadillac prices, or even Pontiac prices, but at Chevrolet prices.”

Many potential acquirers are prime competitors. But they also include venture capital, private equity and hedge funds, all waiting on the sidelines for the economy to indicate its new direction. These organizations are amassing extensive resources for acquisitions they will be targeting over the coming year.

Acquisitions happening in the next several years have the promise of being different from a number of acquisitions that took place prior to the downturn. Many of those acquisitions were characterized by focus on short term gains, with dissembling and reselling of acquired company components for quick turnaround profits. In contrast, a “new normal” is taking shape.

In the “new normal” acquirers view their acquisitions as catalysts for significant value creation. Value creation happens through recombining the capabilities of the acquirer and acquiree in such ways that the newly combined firm can produce offerings that go beyond what it was capable of before. The value creation approach maps out a balanced set of both expense and growth synergies so that both types of synergies

mutually support the creation of value in both the short and long run.

Recent M&A’s – The Jury is Still Out on Their Success

How effective companies are at a value creation approach is, in good part, determined by their level of readiness to take on major acquisitions. Over the next year we will

find out if:

• Bank of America is able to effectively remake itself after its acquisition of Countrywide Financial and Merrill Lynch

• Wells Fargo can integrate Wachovia’s set of capabilities to forge and capture unprecedented opportunities

• JPMorgan Chase is able to take advantage of the unique skills and talents of Washington Mutual for remarkable outcomes

• Pfizer can cull the intangible research assets from Wyeth to power building its next stage drug offerings

• Merck can form a significantly more effective combination through its costly acquisition of Schering-Plough

• Dow Chemical is able to leverage the enhanced capabilities it gained through its Rohm and Haas acquisition to overcome the unpredictability demanding

financial issues that became part of that transaction

These are the high relief examples of the issues that acquiring companies face as that seek out the acquisition opportunities of the next few years. There will be unique

chances open for suitors, but much less tolerance for an “old normal” approach to post merger integration.

Four Levels of Acquisition Capability:

Four Levels of Acquisition Capability:

Moving Your Company through the Next Levels

A major reason for the Newsletter is to update and expand upon understandings and

practices in the post merger integration arena. Our original understandings were

fundamentally sound, but through continuing review and practice the next phases

in understanding emerges.

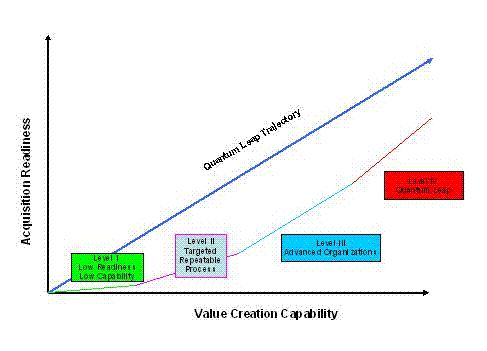

A case in point is the four levels of practice that are found in integrations, which were

first discussed in the Beyond the Deal book (pp. 16-23). The updated understanding

discussed here moves to a more dynamic, stage by stage maturation model. This model shows how companies tend to move incrementally from one stage to the

next, but it also shows that every company has the opportunity shift onto a quantum

leap development trajectory, where it systematically builds the critical integration

capabilities that allow it to realize unprecedented performance and value creation

gains.

Every company taking on major acquisitions has to bring to bear a set of integration

capabilities to succeed. Most companies can find some measure of the necessary

integration capabilities in their already existing organizational processes. The

challenge for companies is to develop the full complement of capabilities so that they

reach the highest levels of performance and value creation.

The Characteristics of the Four Levels

The characteristics of the four levels are:

• Level I: Low Readiness/Capabilities – This is the starting point for most

companies. Acquisitions are opportunistic, with little preparation for acquisition

or being acquired. This type of acquisition has the highest risk for failure.

• Level II: Repeatable Processes – Companies on this next level have greater

readiness but tend to do the same type(s) of acquisition repeatedly with little

new learning or capacity for value creation. These acquisitions focus mainly on

financial synergies and efficiencies. They can achieve a certain degree of

success, but can also lead to the one sided failures of over emphasizing either

expense synergies (Daimler/Chrysler) or growth synergies (AOL/TimeWarner). • Level III: Advanced Organizations – These companies have worked diligently to

comprehensively incorporate continuing learning, codify their knowledge, build

skill and know-how centers, and bring practice knowledge sharing and

mentoring into their acquisitions approach. While these firms place a greater

value on knowledge assets and intangibles, they still tend to see growth

potential synergies as “icing on the cake” and do not exploit them with the rigor

as they do with expense synergies.

• Level IV: Quantum Leap – Quantum leap firms demonstrate substantial

capabilities in both readiness and value creation. They fully explore both

expense and growth synergies. They see acquisitions as not additive but

transformational. A quantum leap company exhibits solid business planning and

project management skills allow for managing the unpredictable. Different

companies have developed particular quantum leap capabilities but no one

company has made has made the leap to become quantum organization.

Ask your self and your colleagues what level they see your organization on. Discuss

what being on that level allows you to achieve and not to achieve. Investigate how

you can use continuous learning to not just improve from one level to the next, but

rather to shift your strategies and actions onto the quantum leap path.

You can start by asking these questions:

• How open is our company to systematically looking into bringing into full play

both growth synergies as well as expense synergies that will lead to quantum

leap gains?

• What unprecedented performance and value creation gains could our company

attain through a major acquisition?

• What could block us from achieving those gains?

• What could enable us to accomplish those gains?

Use the Newsletter to prompt the questions you need to ask that will allow your

company to make this migration. When you make that move your company will begin

to coalesce its core set of acquisition capabilities and be on its path to becoming a

quantum leap organization.

Feel free to get in touch on these and any other issues that will enable your

organization to move to its next stage of integration capability.

Thanks for being part of the newsletter community. Please send in your comments,

contributions and suggestions to: jaychatzkel@progressivepractices.com. They are

important to making the newsletter as relevant to you as possible.

All the best,

Jay Chatzkel

Progressive Practices Progressive Practices | 44123 N. 23rd Street | New Rive

Follow Us!