Welcome to the Beyond the Deal Blog:

Achieving Quantum Leap Acquisition Integrations in Unsettled Times

The world of mergers and acquisitions transitioned in the past year from the recession period of bottom feeding and fire sales (when iconic financial institutions were acquired over a weekend) to the current phase of dominated by sector consolidation (i.e., the Oracle/Sun Microsystems, Delta/Northwest Airlines and United/Continental Airlines transactions). Companies are still not feeling sure footed enough to move for more solidly growth based acquisitions in this “new normal” economy, but that will be coming over the next year.

While conditions have markedly changed the dominant emphasis in acquisitions is on “the Deal”, with only secondary attention tending to be given to the complex but critical work of the integrations that follows. Yet it is the companies that have built up the more developed capabilities in integrations that are generating superior performance.

Integration Capabilities Make The Difference

Dow has weathered a rough sea of economic changes to stay afloat and reconstitute itself by being able to leverage its extensive experience in the integration of Rohm and Haas and the related reshuffling of its assets. Wells Fargo is systematically integrating its Wachovia assets in a process that recognizes the qualities of Wachovia staff and processes. Continental Airlines operations experience may make the positive difference in the outcome of its acquisition by United.

At the same time, Bank of America will continue to suffer through its integration difficulties with its Countrywide and Merrill Lynch acquisitions in its less well conceived and organized integrations. So, integrations capabilities do matter and they do make the critical difference between exceptional outcomes and middling and poor outcomes. This is especially true in during our more unsettled economic era where valuation is not easy or clear, and growth opportunities must be worked at from any number or angles to yield remarkable outcomes.

That is where a good grasp of a companies integration capabilities comes in as well as having the processes in place to build and leverage those capabilities.

Four Levels of Acquisition/Integration Capability: Moving Your Company through the Next Levels

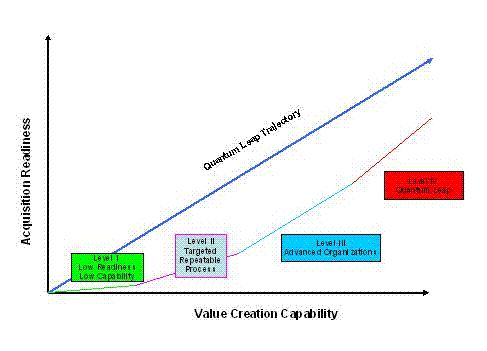

There are four levels of practice found in integrations. Here is a dynamic, stage by stage maturation model that shows how companies tend to move incrementally from one stage to the next, but it also shows that every company has the opportunity shift onto a quantum leap development trajectory, where it systematically builds the critical integration capabilities that allow it to realize unprecedented performance and value creation gains.

A company taking on major acquisitions has to bring to bear a set of integration capabilities to succeed. Most companies can find some measure of the necessary integration capabilities in their already existing organizational processes. The challenge for companies is to develop the full complement of capabilities so that they reach the highest levels of performance and value creation.

The Characteristics of the Four Levels

The characteristics of the four levels are:

- Level I: Low Readiness/Capabilities – This is the starting point for most companies. Acquisitions are opportunistic, with little preparation for acquisition or being acquired. This type of acquisition has the highest risk for failure.

- Level II: Repeatable Processes – Companies on this next level have greater readiness but tend to do the same type(s) of acquisition repeatedly with little new learning or capacity for value creation. These acquisitions focus mainly on financial synergies and efficiencies. They can achieve a certain degree of success, but can also lead to the one sided failures of over emphasizing either expense synergies (Daimler/Chrysler) or growth synergies (AOL/TimeWarner).

- Level III: Advanced Organizations – These companies have worked diligently to comprehensively incorporate continuing learning, codify their knowledge, build skill and know-how centers, and bring practice knowledge sharing and mentoring into their acquisitions approach. While these firms place a greater value on knowledge assets and intangibles, they still tend to see growth potential synergies as “icing on the cake” and do not exploit them with the rigor as they do with expense synergies.

- Level IV: Quantum Leap – Quantum leap firms demonstrate substantial capabilities in both readiness and value creation. They fully explore both expense and growth synergies. They see acquisitions as not additive but transformational. A quantum leap company exhibits solid business planning and project management skills allow for managing the unpredictable. Different companies have developed particular quantum leap capabilities but no one company has made has made the leap to become quantum organization.

Ask your self and your colleagues what level your organization is on. Discuss what being on that level allows you to achieve and not to achieve. Investigate how you can use continuous learning to not just improve from one level to the next, but also how to shift your strategies and actions onto the quantum leap path.

You can start by asking these questions:

- How open is our company to systematically looking into bringing into full play both growth synergies as well as expense synergies that will lead to quantum leap gains?

- What unprecedented performance and value creation gains could our company attain through a major acquisition?

- What could block us from achieving those gains?

- What could enable us to accomplish those gains?

When you move in that direction your company will begin to coalesce its core set of acquisition capabilities and be on its path to becoming a quantum leap organization.

We look forward to hearing from you about what you learn by using this framework, what issues you see and how you can move forward to the next stage of integration capability.

Thanks again for reading. Please let me know what you think of this newsletter and pass it on to friends or people you think might enjoy it.

All the best,

Jay Chatzkel

Principal, Progressive Practices

Tel: + 1 623-826-7294

e-mail: jaychatzkel@progressivepractices.com

websites: www.progressivepractices.com and www.beyondthedeal.net, Newsletter: www.beyondthedeal.net/Newsletter.html

Twitter: https://twitter.com/jchatzkel, LinkedIn: http://www.linkedin.com/nhome/

Follow Us!